Countries Winning the Crypto Race

As users worldwide continue to adopt Bitcoin and altcoins, countries are also gaining traction with their own national cryptocurrencies, with some progressing towards cashless societies. Cipher.Technologies unpacks crypto’s staggering potential, weighing its pros and cons.

Cryptocurrency is seemingly unstoppable, with the adoption of digital currencies increasing at a rapid-fire pace. The first half of 2021 was particularly noteworthy, with crypto users doubling worldwide. While Bitcoin (BTC) and Ethereum (ETH) each had periods of significant growth, the massive jump in adoption can be attributed to altcoins, including Shiba Token (SHIB) and Dogecoin (DOGE). Starting in late April, those altcoins piqued the interest of new users, ultimately leading to a huge surge from 143 million to 221 million crypto users by June, according to a study conducted by Crypto.com, a major digital asset company.

What’s the best cryptocurrency to buy? That depends. Over 15,000 businesses globally now accept Bitcoin. In some countries, crypto-assets are so prevalent they’re becoming mainstream, while others are gaining ground by developing their own national cryptocurrencies. And many nations are gearing up to become completely cashless economies.

Here’s a look at the countries leading the cryptocurrency race — and the circumstances fueling crypto’s upward trajectory.

Setting the Stage for Crypto Users

The United States has taken the lead from China as the world’s largest source of Bitcoin mining, precipitated by China’s crackdown last year on cryptocurrency mining and trading, and it’s also traded $1.52 billion worth of Bitcoin on America’s crypto exchanges in 2020 according to Statista. Still, in terms of usage or ownership, the U.S. lags behind other countries.

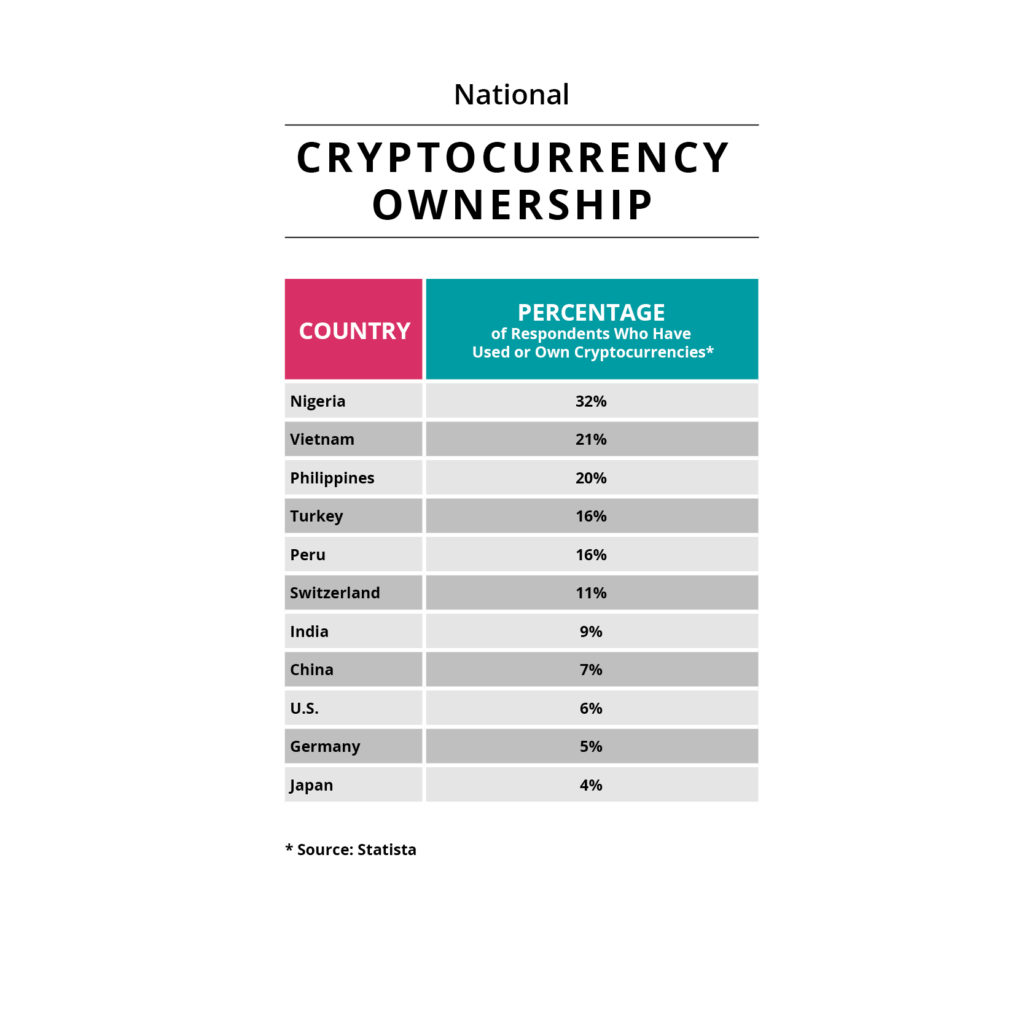

A Statista Global Consumer Survey of 55 countries found that people in Africa, Asia, and South America have adopted cryptocurrencies much more readily than in Europe, North America, or Australia. In Nigeria, for example, 32% of respondents report having used or owned one type of crypto in 2020. Vietnam, the Philippines, Turkey, and Peru were also in the top five, while superpowers, including the U.S., with just 6% jumping on the crypto trend, trailed behind.

The Pros and Cons of Cryptocurrency

What’s the allure of crypto-assets? People can use crypto to make peer-to-peer payments and send money across borders through mobile phones, without incurring high transaction fees. It also engenders financial inclusivity as no bank account is required. Since cryptocurrencies like Bitcoin are capped at a set number of coins, it’s also bulwark against inflation, particularly in poorer countries where inflation is outsized.

The downside: Since crypto is decentralized, no banking middleman is involved, which can make digital currency susceptible to money laundering, electronic hacking, and other illegal activity. That said, virtual currencies are operated through a distributed-ledger technology, instead of one central hub, which means that several global devices work to validate the transaction.

National Digital Currencies on the Rise

But countries aren’t just hitching their digital wagons to Bitcoin and altcoins. Crypto’s popularity, coupled with the growing trend towards cashless societies, are prompting many nations to create, or at least contemplate, their own national cryptocurrencies, referred to as central bank digital currency (CBDC). And in some cases, they may band together: Brazil, Russia, India, China, and South Africa, the countries that make up the BRICS economic bloc, for example, are discussing the possibility of a BRICS nations cryptocurrency that would be issued across countries.

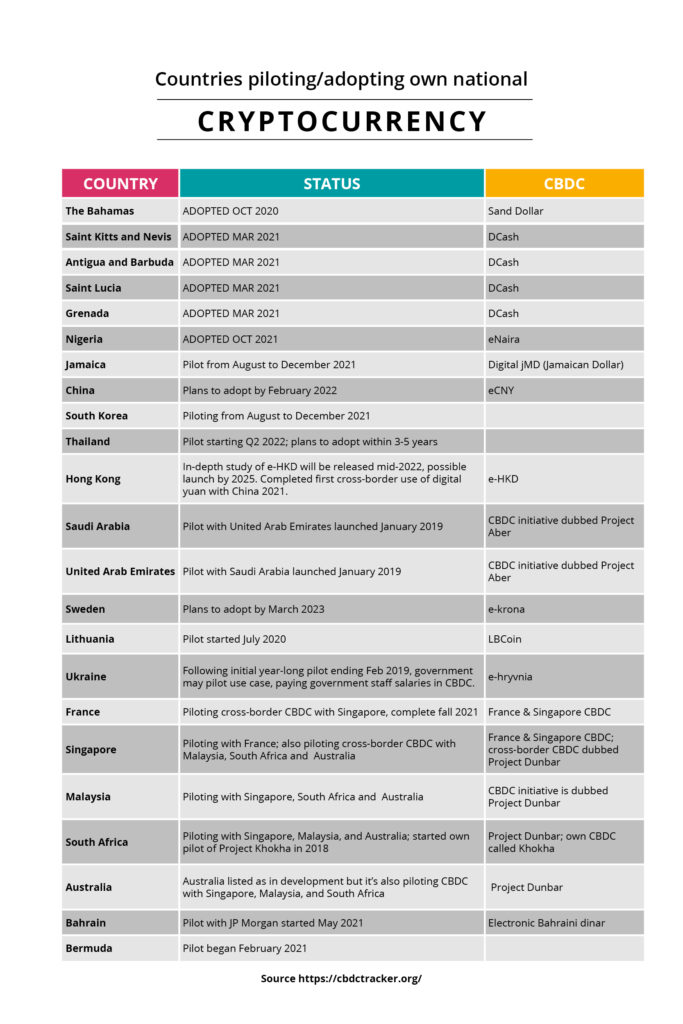

While Bitcoin and other cryptocurrencies employ blockchain technology to stay decentralized, unregulated, and anonymous, CBDC, a digital form of a country’s paper money, lives in cyberspace, and is overseen by central banks. Five small countries have already launched a CBDC: Saint Kitts and Nevis, Antigua and Barbuda, Saint Lucia, and Grenada, which are all members of the Eastern Caribbean Currency Union (ECCU), plus the Bahamas, which was the first to make its digital currency, the Sand Dollar, widely available. And in October 2021, Nigeria rolled out its digital currency, called eNaira.

Cashless Economies on the Horizon

Then there’s China, which started moving towards forming a CBDC in 2014, and began piloting its Chinese national virtual currency, the digital yuan (eCNY) through a central bank–controlled mobile-phone app in 2020. China is anticipated to officially launch eCNY by February 2022, coinciding with the Winter Olympics, held in Beijing. And it’s also expected that eCNY, will totally replace hard cash, possibly making China a cashless country.

Still, China may be second in line to reach that goal. Research from the Central Bank of Sweden (Sveriges Riksbank) indicates that Sweden could become the first totally cashless country, with a 100% digital economy, by March 2023. (In this country of early adopters, people trust the government and banking institutions more than they might in other countries.) A McKinsey Global Payments Report finds that just 9% of Sweden’s transactions are in cash. Norway, where bank notes and coins comprise just 3-4% of transactions, currently has the lowest level of cash usage in the world, with plans to spend the next two years exploring a CBDC.

According to GlobalData, a data and analytics firm, South Korea, Ireland, the United Kingdom, Finland, and Australia, are also at the forefront of becoming cashless economies.

Meanwhile, other sources point to factors like the percentage of population with a credit card and a debit card and usage of contactless payments and e-wallets in determining which nations will be the most cashless within the next five years. Canada, where 83% of the population own a credit card, plus Hong Kong, Singapore, New Zealand, and Japan, make the top five, while Norway and Sweden are also cited as being on the vanguard of cashlessness.

The Pros and Cons of Central Bank Digital Currency

While China’s muscle could trigger the use of the digital yuan in cross-border trade, there are overarching concerns that could hinder its adoption around the world and give foreign companies doing business in China pause. One of the key worries with China’s eCNY is privacy, with the authoritarian government having a window into every step of the transaction flow for individuals and companies, and keeping a tight grasp on that data — what the Chinese government calls “controlled anonymity.” No third party is involved and since eCNY will not only be trackable but programmable, the government could potentially control how it’s used and enforce compliance.

“When China creates a national cryptocurrency, it’s antithetical to the spirit of decentralization. Especially in the case of China it is done to make capital controls easier to implement and to some extent that massively increases the big brother element, this makes it no surprise that the economies at the forefront of progress are China and Russia. The good thing about central bank cryptocurrency is that it means those governments are teasing its adoption but the only thing central bank cryptocurrency and bitcoin have in common is blockchain technology. The upside is that currency transfers will incur lower fees or indeed be fee-free but the downside is the big brother function.”

Gerald Banks, founder and managing partner of Cipher Technologies

Other countries are also entering the CBDC arena — without concerns about government surveillance — because it holds the promise of convenient transactions, it’s more cost efficient than cash, doesn’t always require an internet connection, and unlike Bitcoin and its ilk, can be traced, which deters misuse and illegal transactions. Central banks with CBDCs in the pipeline are also weighing new regulations that offer consumer protections and maintain traditional monetary policy.

According to a tracker created by Atlantic Council GeoEconomics Center, a nonpartisan group that looks at global challenges, 17 countries, including South Korea, Lithuania, Saudi Arabia, Thailand and Sweden, are already piloting national cryptocurrencies. As of July 2021, 81 countries are investigating the potential of a CBDC, a huge leap from 35 countries last May. Those 81 countries represent more than 90% of global gross domestic product.

Out of the four countries with the biggest central banks — Europe, Japan, England, and the United States — the U.S. tails the rest in terms of its CBDC progress.

All investments carry an element of risk, this article is not intended to replace professional financial advice.